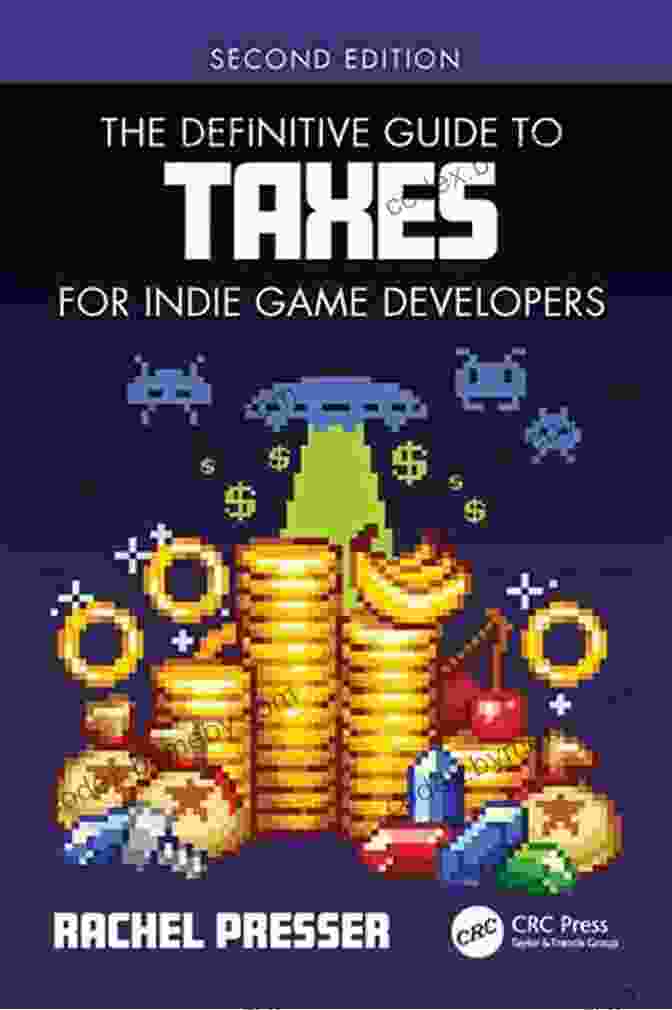

The Definitive Guide to Taxes for Indie Game Developers: Unlocking Financial Success

As an indie game developer, navigating the complex world of taxes can be a daunting task. However, understanding and managing your tax obligations is crucial to maximizing your earnings and protecting your financial interests. 'The Definitive Guide to Taxes for Indie Game Developers' is the ultimate resource designed to empower you with the knowledge and strategies needed to master tax laws and achieve financial success in the gaming industry.

5 out of 5

| Language | : | English |

| File size | : | 2177 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 246 pages |

| Lending | : | Enabled |

Chapter 1: Understanding Tax Basics

This chapter provides a comprehensive overview of tax principles and terminology. You will learn about different types of taxes, tax brackets, and exemptions. Understanding these basics is essential for laying a solid foundation for effective tax planning.

Chapter 2: Business Structure and Tax Implications

The choice of business structure significantly impacts your tax liability. This chapter explores various business structures, such as sole proprietorships, LLCs, and corporations, and their tax implications. You will gain valuable insights into selecting the right structure for your indie game development business.

Chapter 3: Income Taxation for Indie Game Developers

This chapter delves into the different types of income earned by indie game developers and their corresponding tax treatments. You will learn about regular income, royalties, and investment income. Additionally, you will discover strategies for maximizing deductions and minimizing your overall tax liability.

Chapter 4: Expense Deductions and Business Expenses

Expenses are an essential part of any business operation. This chapter provides a detailed explanation of eligible business expenses and how to deduct them from your taxable income. You will gain knowledge of the most common deductions, including advertising, travel, and equipment costs.

Chapter 5: Tax Credits and Incentives for Game Developers

Various tax credits and incentives are available to indie game developers. This chapter explores these opportunities, such as the R&D tax credit and the Work Opportunity Tax Credit. You will learn how to qualify for these incentives and maximize your savings.

Chapter 6: Tax Audits and Avoiding Common Mistakes

Tax audits are a common reality for businesses. This chapter provides valuable tips on how to prepare for an audit and minimize the chances of errors. You will also learn about common mistakes indie game developers make and how to avoid them.

Chapter 7: Tax Planning and Strategies

Effective tax planning is crucial for long-term financial success. This chapter introduces various tax planning strategies, such as estimated tax payments, retirement contributions, and investment vehicles. You will gain insights into reducing your tax burden and building a secure financial future.

'The Definitive Guide to Taxes for Indie Game Developers' is an indispensable resource for any indie game developer seeking to thrive in the competitive gaming industry. By mastering the tax laws and implementing effective strategies, you can maximize your earnings, minimize your tax liability, and achieve financial independence. Embrace the knowledge and guidance within this guide and unlock the full potential of your indie game development career.

Free Download your copy of 'The Definitive Guide to Taxes for Indie Game Developers' today and embark on a journey of financial empowerment.

Free Download Now

5 out of 5

| Language | : | English |

| File size | : | 2177 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 246 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Chuck Collins

Chuck Collins Laura Mckowen

Laura Mckowen Christine Copper

Christine Copper Chip Munn

Chip Munn Choly Knight

Choly Knight Stephen J Collier

Stephen J Collier Patrick Santiago

Patrick Santiago James Barbato

James Barbato Chris Blackley

Chris Blackley Cj Lyons

Cj Lyons Phil Jimenez

Phil Jimenez Coco Simon

Coco Simon Kinshasha Holman Conwill

Kinshasha Holman Conwill Kate Staves

Kate Staves Simi Linton

Simi Linton Mostyn Heilmannovsky

Mostyn Heilmannovsky Karen Bonvillain Bull

Karen Bonvillain Bull Wassily Kandinsky

Wassily Kandinsky Christopher Bruhn

Christopher Bruhn Robert E Quinn

Robert E Quinn

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Darnell MitchellFollow ·14.4k

Darnell MitchellFollow ·14.4k Colt SimmonsFollow ·8.1k

Colt SimmonsFollow ·8.1k Brian WestFollow ·13.7k

Brian WestFollow ·13.7k Ivan TurnerFollow ·8.9k

Ivan TurnerFollow ·8.9k Jared NelsonFollow ·19.1k

Jared NelsonFollow ·19.1k Abe MitchellFollow ·17.5k

Abe MitchellFollow ·17.5k Adam HayesFollow ·11.7k

Adam HayesFollow ·11.7k Luke BlairFollow ·16.7k

Luke BlairFollow ·16.7k

Rick Nelson

Rick NelsonThe Power of Positivity: 51 Motivational Quotes to...

In the tapestry of life, we encounter...

Lee Simmons

Lee SimmonsThe Indian War of 1864: A Devastating Conflict in the...

The Indian War of 1864 was a brutal...

Eddie Bell

Eddie BellQueen: The Unauthorized Biography: Unraveling the Secrets...

Prepare to delve into the captivating...

Dion Reed

Dion ReedUnveiling the Imperfect Gems of Trauma and...

In the tapestry of...

Desmond Foster

Desmond FosterThirty-Six Years in the Rockies: A Timeless Masterpiece...

A Journey Through Time and...

5 out of 5

| Language | : | English |

| File size | : | 2177 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 246 pages |

| Lending | : | Enabled |